Which Languages are Most In Demand for Translation?

The translation industry is unique.

It comes into contact with almost every industry and market on earth.

This means it’s influenced by the global economy, national economies and economic trends in different industries.

These components interact with one another and individual decisions by companies.

The end result means demand for any given translation service can vary at any given moment.

So, answering which language or language combination is most in demand is difficult. It depends on several important factors.

Let’s take a look at them.

What do we mean by in demand languages?

According to Merriam-Webster’s definition, in demand is an idiom that means:

needed or wanted by many people

The sheer range of industries and language pairs involved in translation services means that answering a more precise question would be:

Which languages are most in demand for translation [here] [at this time]

Let’s try and answer these two points.

Where the demand is

Where you are when you are looking to find or offer translation services will have an impact on how in demand it is.

Generally speaking, native speakers of the language combination’s target language (the ‘going into’ language) are required.

These translators can usually be found in one of two places:

- In the market where the target language is spoken

- In the market where the source language (‘translating from’) is spoken

Example of language combination demand: French to Japanese

Imagine a French company is looking for French to Japanese translation.

Native Japanese translators who translate from French would most likely be found in Japan or France.

But native Japanese translators in France would be more accessible. Searching on Google in France or asking French industry networks would likely produce results of translation services based in France.

Here, the French company will also be competing with all other French companies looking for the same service at the same time.

A Japanese company looking for the same service will have the same issue in reverse. In both cases, the demand for the service depends on the number of translators available in that market.

If you outsource your translation to a language services provider (LSP), they might have direct or indirect access to both markets. If not, you might be able to find a recruiter who can.

The key word in the above two sentences is ‘might’. In short, the demand in your market will likely reflect your choice of translator and the rates you pay.

When the demand is

Demand for different translation (or interpretation) services can fluctuate just like it can for any other product or service.

During some particularly busy working periods, it might be almost impossible to find translation services that are usually available.

For example, if UN is in town, you are unlikely to be able to find high-level simultaneous interpreting services for its official languages (Arabic, Chinese, English, French, Russian and Spanish).

Political events, economic policies, pandemics, and natural disasters might also cause a rise or drop in demand for a given language in a given place.

For example, if Germany and Brazil announced a series of policies related to exports between the two countries in certain industries, then demand for German and Portuguese translation services for those industries would rise.

Macro trends can also appear suddenly. China’s economic reforms of the 1980s saw huge economic growth and trading with other countries. For four decades before (including during the Second World War), the demand for commercial translation services there was very low.

Highest-paying translation languages (/language combinations)

Once you know where and when a particular translation is needed, one way to measure its demand is its cost.

After all, the translation business operates in the free market. This gives us a robust way to measure demand – by looking at what highest paying languages are.

But of course, we do also need to consider location again. So, if German to Italian translation costs £0.08 per word but the reverse language pair costs £0.09 in the UK, can we tell from this which is more in demand?

Not necessarily. The figure could represent the demand for each pair, how well-supplied they are, or just the relative costs in each target market.

Languages connected to markets with the highest GDP

The size of a country’s economy can often be a sign of how much economic activity takes place there. This could be a sign of how in demand translation services are there, too.

However, there are three main approaches for calculating/measuring GDP (gross domestic product):

- Nominal: The total dollar value for all goods and services produced in a given period without adjusting for inflation or price changes

- Real: This takes into account changes in the price level over time to eliminate the effects of inflation and deflation.

- Per capita: This discounts the effects of inflation and deflation by dividing the total nominal GDP of a country by its total population

It is possible to have countries with larger GDP’s that import less than smaller ones with higher GDP per capita.

These countries that import more might also have a higher demand for translation services – or might give companies from exporting countries more demand for it.

Most spoken (first) languages

There are 195 countries on earth and over 7,000 languages. But well over half of the world’s 7.8 billion people have one of the top ten languages as a native language.

The number of speakers of a language is one way to look at how much demand for translation in it there might be.

1. Mandarin Chinese

Mandarin Chinese (the official Chinese language) could have approximately 1 billion native speakers and is spoken in China, Taiwan, Singapore, parts of Malaysia and Indonesia.

The ‘could’ above serves as a caveat. Back in 2014, the Chinese Ministry of Education stated (in a report now taken offline) that:

30 per cent of our nation’s population does not speak Putonghua [Mandarin], and out of the 30 per cent of the population who possess Putonghua skills, only 1 in 10 can speak Putonghua particularly and fluently.

– Chinese Ministry of Education, 2014

However, each year since then approximately 100 million schoolchildren have entered the Chinese education system, which uses Mandarin. So it’s safe to say that the number of speakers is still growing at least.

2. Spanish

The Spanish language has approximately 500 million native speakers and is spoken in Spain and most of Central and South America.

It is an official language of the UN and owing to demographics, the number of speakers is growing, too. The Cervantes Institute estimated that the number of new Spanish speakers grew by 6 million between 2019 and 2022.

3. English

English has approximately 400 million native speakers. It is not only the official language of 67 countries, but also serves as a lingua franca (common language) around the world.

In the USA (the largest English-speaking country), 80% of people are monolingual. And in the UK, it’s estimated that 95% are.

This has implications when looking for translation with English as the target language.

4. Hindi

Hindi has approximately 322 million speakers. It is spoken throughout most of India, and in parts of Nepal, Bangladesh, Pakistan, Fiji, Mauritius and Suriname.

It is written using the Devanagari script, which has been in use since the 4th century CE (and came from Brahmi, which was developed around 600 BCE).

Interestingly, about 10% (roughly 140 million) of Indians also speak English as a second or third language. This means it is often used to overcome language barriers in areas like business.

5. Bengali

Bengali has approximately 300 speakers. It is the official language of Bangladesh and is also spoken in parts of India.

It uses the Bengali script, which to outsiders looks similar to Hindi’s Devanagari script (which in recent years it has evolved to resemble more).

6. Portuguese

Portuguese has over 200 million speakers based mainly in Portugal and Brazil.

The population of Brazil is 215 million, whereas Portugal’s is 10 million. Brazil’s GDP is approximately 1.6 trillion (and USD approx $7,500 per capita), whereas Portugal’s is 253 billion (and USD approx $24,500) per capita.

These figures give some hint towards which version of Portuguese is in demand for translation (or localization).

7. Russian

The Russian language has approximately 156 million native speakers and is spoken in Russia and parts of Ukraine, Kazakhstan, Belarus, Moldova, the Baltic nations, and Kyrgyzstan.

The Russian language is thought to be around 1,400 years old. This makes it one of the oldest languages in Europe today.

It uses a Cyrillic writing script, which is an alphabet derived from the Greek alphabet.

There are an estimated 60 million people who speak Russian as a second language.

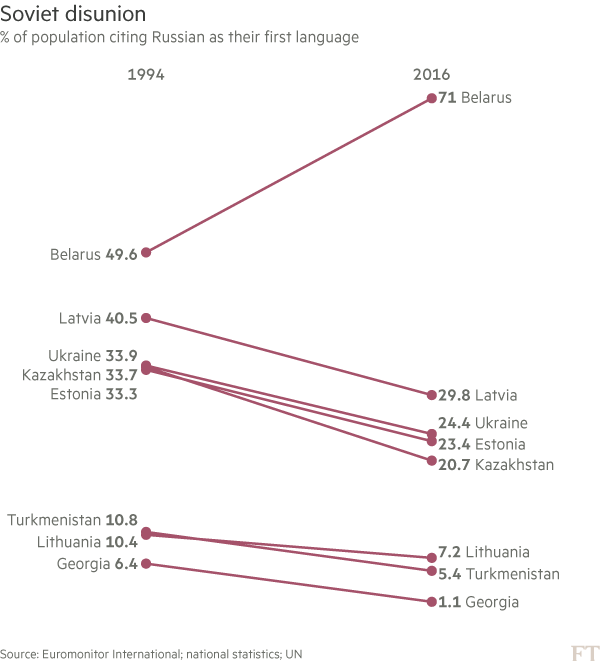

However, according to a 2017 Financial Times report, UN statistics show the Russian language has “lost more ground than any other language over the past 20 years as newly independent former Soviet states have attempted to assert their linguistic sovereignty.”

8. Japanese

Japanese has approximately 125 million native speakers, the vast majority of which are in Japan.

It uses two writing distinct writing scripts: Kana and Kanji.

Kana is comprised of two syllabaries, Hiragana and Katakana. The former is a cursive script used for native Japanese words, while the latter is reserved for onomatopoeia and words from other languages.

Kanji are Chinese characters pronounced differently in Japanese. They have been used in Japan since at least the 5th century B.C. Today around 2,000 are commonly used for everyday use and many more exist in total.

Future demand of languages: Will AI replace human translators?

The demand for human translation could be reduced or even replaced by the supply of machine and AI translation.

This is already playing out across the translation industry…

An increasing number of translators are finding that there is a high demand for ‘post editing‘ work. This is when human translators edit translations created by machine learning.

The rate translators can charge per word for this is less than traditional translation work. However, their input is also increased considerably.

Conclusion

Defining how to measure demand for translation languages is difficult.

The location of the translator, market, industry, timing and – of course – supply can all influence the demand.

Many claim that price reflects the highest demand. But this rule doesn’t always hold: rare languages with low demand cost more simply because there is less supply.

So, French language translators, for example, may not be paid as much as Dutch translators if there is a glut in the supply of French translation services.

Using different GDP, importing and exporting metrics can also give a clue as to where translation may be needed.

After all, the financial and corporate sectors are where most translation takes place. So, the languages associated with hotspots of powerful economies are often (but not always) in very high demand.

Understanding which languages are the most spoken globally is also useful. By this metric, Chinese translators could be the most sought-after.

All of the above angles are worth considering. However, so too is machine learning and AI and the full impact it might have on the industry in the future.

Measuring demand for translation services is complex due to factors like location, market, industry, and supply. While high prices can indicate demand, rare languages can cost more due to lower supply. Considering GDP, trade metrics, and prevalent global languages provide additional insights. The future impact of AI and machine learning on the industry is also a crucial aspect to watch